Digital Marketing Act – Perspectives on Changes for Digital Advertising

Sylvain DEFFAY, Senior Manager Media, digital marketing expert, shares his initial observations and some perspectives on the impact of the DMA on the digital advertising industry.

Key Takeaways

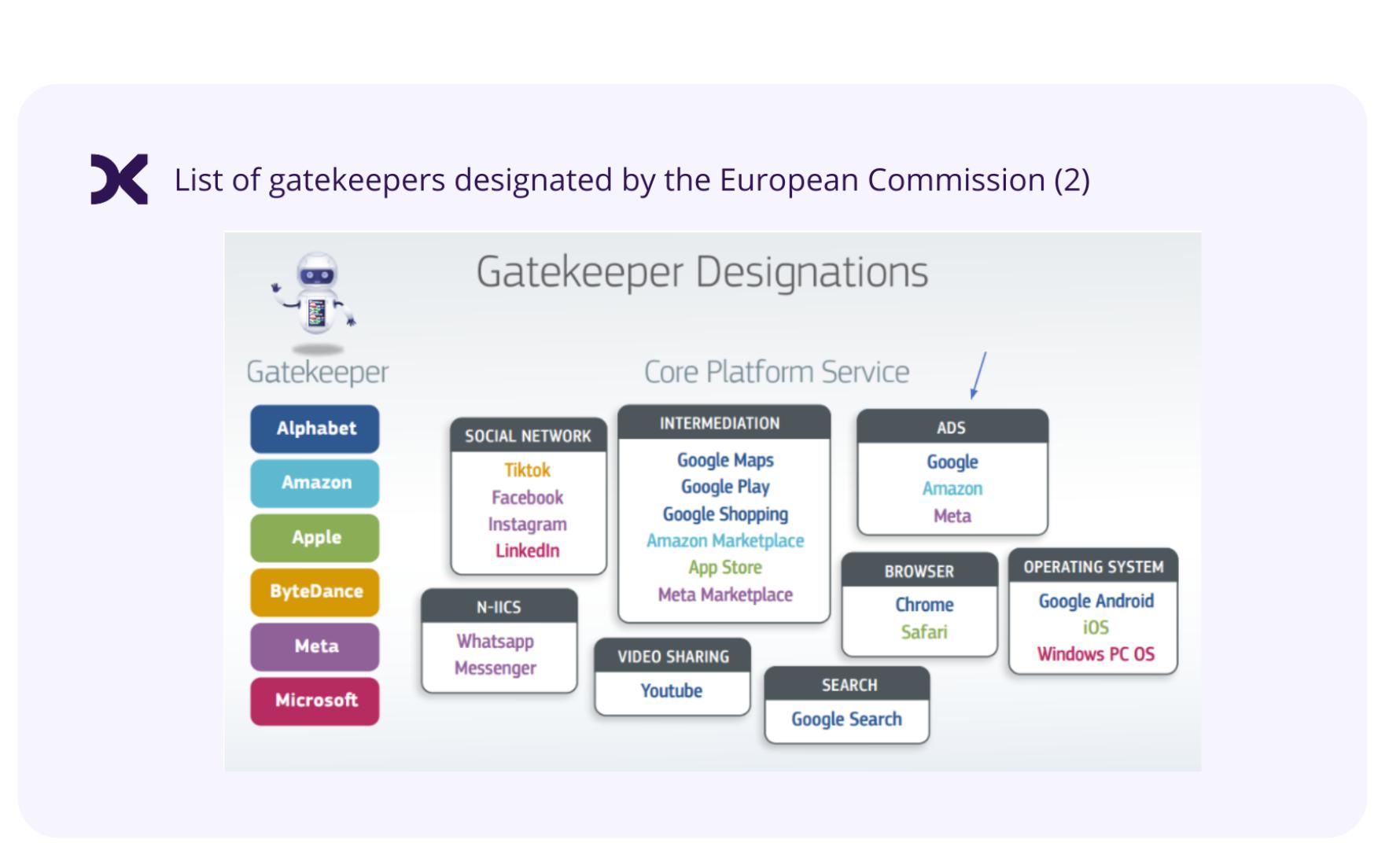

- It has now been over a year (November 2022) since the Digital Markets Act regulation of the European Union came into effect, covering 22 “essential platform services” belonging to 6 “gatekeepers.”

- Although applicable since May 2023, the first changes began to emerge at the end of last year, and they are significant.

- Google initiated the first major change when it announced in December 2023 the rollout of Consent Mode v2, conditioning many measurement and targeting use cases on its deployment, all within a 3-month timeframe.

- Other advertising solutions will also be impacted, as advertising offerings from Meta and Amazon are similarly affected.

- Starting March 6, the European Commission will review the actions taken by the gatekeepers and may require further modifications.

Overview of the DMA Stakes

The Digital Markets Act (DMA) is part of a legislative package along with the Digital Services Act (DSA) established by the European Union at the end of 2022. These two regulations came into effect on May 2, 2023 (DMA) and August 25, 2023 (DSA).

“The DMA aims to better regulate the economic activities of the largest platforms. These large companies are referred to by the Commission as ‘gatekeepers’ to indicate that they have become essential gateways to access the benefits of the internet. They are accused of making smaller businesses and consumers particularly dependent on their services and of stifling competition from other companies.”(1)

The DSA, on the other hand, addresses harmful content (hate speech, child pornography, terrorism, etc.) and illicit products (counterfeit or dangerous) offered online.

Here, we focus on the DMA.

In September, the European Commission designated the 22 platforms covered by the DMA, which belong to six digital giants: Alphabet (Google Search, Android, Maps, etc.), Amazon, Apple, ByteDance (TikTok), Meta (Facebook, Instagram, WhatsApp, etc.), and Microsoft.

The measurement and digital advertising offerings provided by Google, Amazon, and Meta fall within the scope of the DMA. The regulation consists of around twenty obligations and prohibitions directed at the largest web platforms, which can be grouped into three main themes:

- Ensuring fair competition in the European market and avoiding self-preferencing.

- Protecting users and respecting their consent (already stipulated by the GDPR).

- Promoting innovation by opening platforms and algorithms.

The services subject to the DMA had until March 6, 2024, to comply with their obligations.

Among all the required modifications, the update to Consent Mode by Google Ads appeared to be the most impactful in the short term.

Required Update of Google’s ‘Consent Mode V2’ on Websites and Applications

Originally an optional module, ‘Consent Mode’ (COMO) has evolved into a second version and has now become mandatory for effectively managing digital campaigns.

Indeed, Consent Mode v2 allows for the maintenance of major use cases:

- Conversion reporting in Google Analytics 4, Google Ads, or the GMP suite, whether collected on-site, in-app, or via offline conversion imports and in-store sales.

- Audience activation in Google Ads or GMP from tags or SDK.

- Audience activation from customer match uploads (manual or API).

‘Consent Mode V2’ operates by modeling the behavior of users without consent and aids in campaign management by simulating conversions in reporting.

This shift from deterministic to probabilistic measurement (for those who did not deploy version 1) necessitates the organization of a change management plan.

- Monitor conversion discrepancies and conversion rates before and after March 6, as well as the corresponding acquisition costs. Since the minimum required data for modeling is more stringent under version 2, the number of conversions may decrease.

- For the many advertisers who manage media based on GA conversions and audiences, ensure that all bidding strategies are properly reconnected to GA4 conversions. Consent Mode V2 does not apply to Universal Analytics, so a post-March 6 verification is necessary. The same applies to audiences, which must now systematically originate from GA4.

- Consequently, all reporting and performance or audience tracking dashboards will need to be reconfigured and verified to use GA4 sources instead of GA360.

- Finally, a training plan and an update of internal documentation on the use and analysis of the newly reported data should be prepared.

The requirement to use ‘Consent Mode V2’ is a significant change as it has been imposed on everyone in a very short time. Simultaneously, other platforms have already announced adaptations that will impact the digital advertising market in the long term.

A long list of changes, expected to evolve

Among the changes brought about by the DMA, we primarily note:

- META’s announcement to completely (temporarily) stop advertising to minors from November 6, despite the DMA only prohibiting behavioral targeting of minors. This sudden challenge was especially impactful for toy and video game advertisers just before the holiday season.

- We have all noticed on META and Google platforms requests for confirmation of the association between their different services. In cases of application dissociation, this could reduce the volume and quality of some addressable segments.

- Numerous discussions are ongoing regarding the future appearance of Google product response pages and the handling of CSS product feeds. A new “product site” tab has already begun to appear on certain queries. It will be interesting to observe the DMA’s impact on the business potential of comparison sites and indirectly on shopping campaign acquisition costs.

- Changes are also expected for local directories. A new “place sites” tab has appeared on Google’s SERP. Local directories like Mappy and Pages Jaunes had suffered greatly from Google’s natural referencing towards its Google Maps service, something the DMA aims to correct. Potential impacts on campaigns aimed at driving in-store traffic should be monitored.

- Finally, from a perspective of advertising buying tools, the DMA is expected to accelerate the availability of YouTube inventory on competing purchasing platforms: DSPs and paid media platforms, similar to what occurred in the past (2015).

Starting today, March 6th, it is up to the European Commission to verify the compliance or non-compliance of the new measures implemented by the 22 platforms concerned. To do this, the DMA requires that each gatekeeper demonstrate through their own analyses in an annual report that the mechanisms put in place have the expected effects as outlined by the regulation.

Clearly, both users and organizations will also be able to challenge the positions of the gatekeepers themselves. This is already the case with Apple, which, as of March 1st, has been accused of only partially complying with the DMA in a letter sent to the European Commission by 34 organizations.

It will be fascinating to observe whether the European Union and the DMA succeed in shaping our digital ecosystem and the digital advertising sector.

A topic to watch in the coming months.

Sources

- https://www.touteleurope.eu/economie-et-social/numerique-que-sont-le-dma-et-le-dsa-les-reglements-europeens-qui-veulent-reguler-internet/#:~:text=Le%20Digital%20Markets%20Act%20(DMA,second%20le%2025%20ao%C3%BBt%202023.

- https://ec.europa.eu/commission/presscorner/detail/en/ip_23_4328

- https://www.lefigaro.fr/societes/apple-epingle-par-34-organisations-pour-son-respect-en-demi-teinte-des-reglementations-europeennes-20240302