Using data to anticipate and mitigate the impact of stockouts in e-commerce

Antoine de Sainte Marie is a Manager at Converteo. His areas of expertise focus on digital and e-commerce strategies and their deployment.

Key Takeaways

- Stockouts contribute to customer frustration and represent missed opportunities for e-commerce retailers to convert customers.

- Data enables the anticipation and mitigation of the impact of stockouts in e-commerce.

- It must be combined with the adaptation of pricing, traffic acquisition, and the customer journey in the era of omnichannel.

In e-commerce, optimizing stock levels is a key to success. Finding the balance between stockouts and overstocking can be challenging without analyzing data to optimize existing processes. An e-commerce retailer facing stockouts deals with both customer frustration and lost revenue to competitors.

For instance, the unavailability of a product is considered the second biggest irritant when purchasing a non-food product, just after the absence of pricing (OpinionWay, 2024). Customer sensitivity to unavailability is particularly pronounced in product categories that are most affected by stockouts (fashion, home equipment, and electronics).

However, data enables e-commerce retailers to monitor product availability, adjust their pricing strategy, optimize traffic acquisition, enhance the customer journey, and even leverage omnichannel strategies. Let’s explore these levers in more detail to anticipate and mitigate the impact of stockouts across the entire value chain.

Monitoring Product Availability

A first consideration should be made regarding the rationalization of the product assortment. The broader and deeper the assortment is in covering the full range of customer needs, the more likely it is to suffer from stockouts or waste. The variations of a product are factors that affect production, supply, and storage capacities, especially for scarce product categories.

Next comes the challenge of managing product availability. Key indicators such as the percentage of products published online, the availability rate, and the stockout rate are crucial. These can be supplemented by data on the turnover rate of the assortment and the average time required to restock a product. On direct-to-consumer online distribution channels, these figures are relatively easy to manage. In e-retail, it is generally necessary to equip oneself with a third-party solution known as on-shelf monitoring.

In the era of second-hand goods, tracking product availability is even more critical, as if an e-retailer is out of stock on a product, customers are more likely to turn to alternatives like Vinted, LeBonCoin, or Vestiaire Collective. In response to this trend, players like Stockly offer e-retailers stock completion solutions to prevent lost sales, of course, in exchange for a commission paid to the partner facilitating the transaction.

Adapting Pricing Strategy

When demand exceeds the number of products available in the market, prices tend to increase. Dynamic pricing can be employed to gradually raise prices as stock levels decrease. This requires prior elasticity studies to assess customer sensitivity to price variations, ensuring that it does not harm the e-retailer’s long-term price image. Depending on the category, optimizing the impact of stockouts through pricing may be more or less relevant (e.g., food products).

Regarding promotions, a best practice is to avoid launching promotions on products with limited stock. Similarly, efforts should be made to increase stock levels for products that will be subject to significant promotions. In an e-commerce market where price comparison is facilitated, consider this striking statistic: 22% of consumers purchase products from their favorite brands only when they are displayed with discounts (Invesp, 2023).

Optimizing Traffic Acquisition

For organic channels, an out-of-stock product remains visible on the site to avoid negatively impacting algorithm performance and SEO ranking. Additionally, from a customer experience perspective, it is more pleasant to access the product page with a “temporarily out of stock” notice rather than landing on a 404 error page. To take this further, it is possible to offer customers the option to be notified when the product is restocked.

Paid acquisition channels, on the other hand, require the suspension of certain investment campaigns. Thus, Google Shopping, SEA, and retail media channels can be paused during stockouts and resumed afterward. This practice has a positive effect on the overall profitability of the e-commerce channel.

In CRM, it is crucial to limit the promotion of out-of-stock products in communications to customers, or even to offer alternatives to encourage them to consider other products. Furthermore, e-commerce retailers also notify their customers when high-demand products are restocked.

Adapting the Customer Journey

To adapt the customer journey, it is necessary to understand the behavior of customers who were about to purchase an unfortunately unavailable product. Some will postpone their purchases, while others may prefer a competing option or a different distribution channel. These decisions vary significantly based on the level of involvement of the category and the competitive pressure it faces. Brand loyalty also influences customers’ patience.

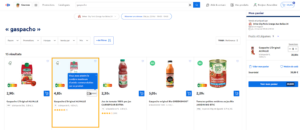

It is essential to adapt the customer journey to maintain customer satisfaction. For high-demand or highly seasonal products, one solution may be to limit the quantities that can be purchased per customer. This approach prioritizes satisfying a larger number of customers rather than a few, as illustrated by recent limitations during COVID-19 or Carrefour with its gazpacho range in the summer.

In addition to notifying customers when a product is back in stock, a good practice is to offer alternatives by adapting merchandising. Non-food products can also be subject to a pre-order system.

In any case, managing customer relationships requires e-commerce retailers to communicate transparently with their buyers in the event of stockouts. 41% of French consumers return later to check if the product is back in stock, highlighting the importance of maintaining a trusting relationship and open, transparent communication with customers (UPS). These efforts help maintain high customer satisfaction indicators (NPS) and alleviate the customer service workload.

Using Data Wisely

Stockouts affect various teams within the organization, which must pool the available data to use it effectively. This is a prerequisite for sharing a unified and coherent view of real-time inventory.

The collection, consolidation, and accessibility of data enable several high-value use cases. In e-commerce, mature players adopt auto-replenishment to automate stock replenishment before facing a stockout situation. Additionally, distributors and suppliers can share their stock levels in real-time and transparently in a collaborative manner. In the same vein, sales forecasts play a key role in anticipating consumption trends based on historical data collected thus far. Finally, correlation studies through Marketing Mix Modeling (MMM) help measure the impact of seasonality or promotions on sales and, consequently, on inventory levels.

Adopting an Omnichannel Approach

If it were limited to the e-commerce channel, the issue of stockouts would lose its significance. In an omnichannel world, anticipating and minimizing their impact requires consideration of physical retail locations. A unified inventory between digital platforms and stores facilitates the management of product availability, whether through regular inventory checks or the adoption of RFID tags.

Services like Click & Collect, Ship from Store, and Return in Store break down the barriers between in-store stock and e-commerce inventory. Some players go even further by displaying real-time product availability in-store on their e-commerce pages, as seen with Fnac-Darty. Since e-commerce and physical distribution operate under different cost structures, omnichannel strategies must integrate profitability considerations (differences between fixed and variable costs, the impact of delivery pricing on the e-commerce P&L, etc.).

Finally, implementing a safety stock for products where the impact of stockouts is significant can be justified. This stock is calculated based on two variables: sales (maximum and average) over a period and delivery times (maximum and average). This safety stock provides protection against fluctuations in demand and replenishment delays, thereby ensuring better product availability.

Conclusion

Minimizing the impact of stockouts in e-commerce requires a multidimensional approach that includes rigorous inventory management, adaptation of pricing strategies, optimization of traffic acquisition, and strategic use of data. By adopting these practices, e-commerce retailers can not only reduce stockouts but also enhance customer satisfaction and loyalty. Let’s get in touch to ensure that your existing practices are optimal regarding this high-value topic!

Contributor : Amandine Nogier, Clément Delille